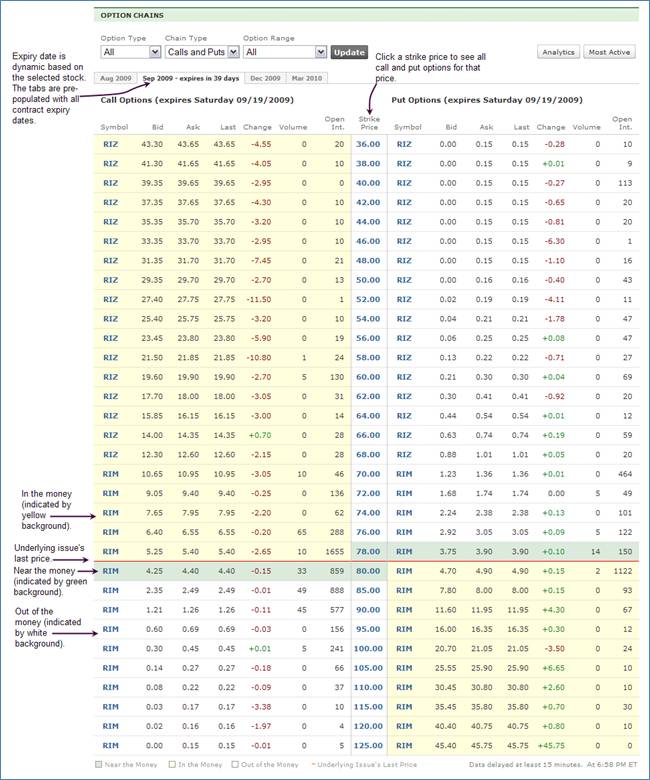

Non-Analytics View

Click the strike price, for example, $48.00, to display all call and put options for that price.

It is the price at which the

option holder can buy or sell the shares. When an option is listed, the strike

prices are set closely to the underlying stock price at the time of listing.

Since the stock price could go up or down before the option expires, at least

five strike prices (generally, two strike prices in-the-money, one strike price

at-the-money and two strike prices out-of-the-money) are established for the

same expiry month. For call options, the higher the strike price compared

to stock price, the lower the value of the option. For put options, the

higher the strike price compared to stock price, the greater the value of the

option.